Gaming Development

Digital games distribution is ripe for disruption

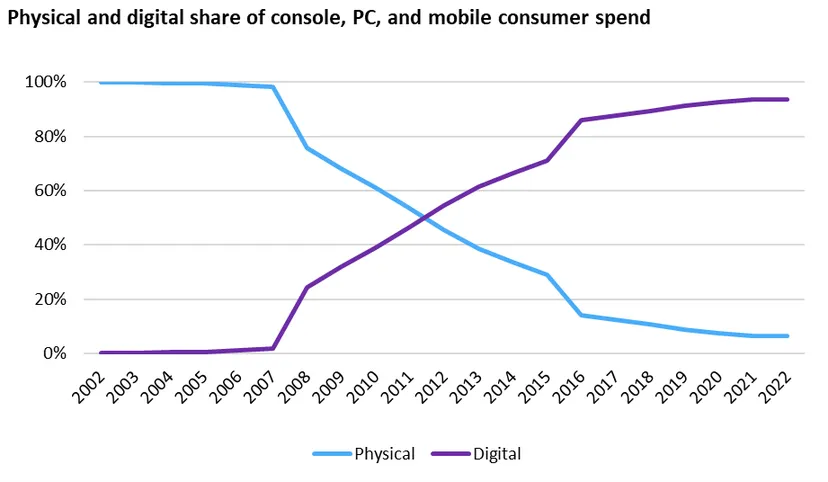

It’s shocking from the vantage level of 2023 to contemplate how just lately digital distribution took over the video games market. We take it as a right now that almost all video games are distributed digitally, nevertheless it was solely in 2012 that digital video games income overtook income from boxed video games. Within the console market, the crossover wasn’t reached till 2017. Within the broader historical past of the video video games business we’re nonetheless truly fairly early within the period of digital video games.

An enormous quantity of market energy accrued to only a handful of platforms within the first decade or so of the digital period. Apple and Google’s cell app shops have digital monopolies on distribution on their respective platforms, as do Sony, Microsoft, and Nintendo’s console storefronts, whereas Steam dominates to an solely barely lesser extent on PC. By now, 94% of video games spending is digital, so these six platforms specifically have come to occupy a important market place which allows them to extract charges upwards 30% of gross sales from publishers that use their platforms. Consequently, distributors have been capable of gather, by Omdia’s estimates, a complete of $41bn from publishers in 2022. However whereas video games distribution will definitely proceed to be a profitable enterprise, there’s good purpose to assume that the excessive watermark of distributor dominance within the video games market has been handed.

Distributors are beginning to face stiffer competitors

Distributors are capable of cost excessive charges as a result of entry to their platforms is indispensable to publishers and since they face little efficient competitors. The three consoles and iOS are closed platforms over which Sony, Microsoft, Nintendo, and Apple train an absolute monopoly on the distribution of software program. Android and PC are extra open, with a number of storefronts in operation, however in observe community results make it extraordinarily tough to problem the dominance of Google Play and Steam.

Nonetheless, in every case a well-funded challenger is making an attempt to tackle the most important incumbent. On Android, Huawei is hoping to make its App Gallery a reputable different to Google Play past its dwelling market of China; whereas on PC, Epic Video games has poured lots of of tens of millions of {dollars} into creating the Epic Video games Retailer as a challenger to Steam. It’s truthful to say that neither of those efforts has to date met with resounding success, and each Huawei and Epic have considerably idiosyncratic causes for pursuing these longshot ventures.

However what makes these vital developments is that they arrive within the context of a regulatory surroundings which is rising way more hostile to something which smacks of a monopoly in tech. This can make it a lot tougher for the incumbent gamers to close down challenges to their positions than previously. The European Fee, as an illustration, is evaluating whether or not Apple’s monopoly on iOS software program distribution is a violation of competitors regulation, with some experiences suggesting that Apple could also be contemplating getting forward of a possible ruling by opening the door to third-party app shops voluntarily. Any such improvement on iOS can be alarming for the console platform holders given the parallels with their very own distribution monopolies.

The video games market is evolving in methods which might be laborious for platforms to regulate

Maybe an excellent greater risk than the rise of recent direct rivals is the weakening potential of distribution platforms to regulate the income flowing into the video games they host. Multiplatform video games specifically are beginning to pose an enormous problem. In most multiplatform stay service video games, an in-game buy made on any gadget will make the gadgets or content material bought obtainable throughout any gadget the sport is performed on. The selection of buying gadget is irrelevant from the participant’s perspective, however nonetheless makes an enormous distinction to how the cash is split between writer and distributor. This creates an incentive for publishers to push gamers in direction of cheaper platforms with a extra beneficiant income share, and even to purchase from them straight over the online and reduce out the intermediary solely. Unsurprisingly, distributors don’t like this, and their refusal to permit publishers this feature is the core of the Epic Video games v. Apple authorized dispute.

Whether or not or not Epic will get its means in court docket (and proper now it doesn’t appear like it’s going to), that is prone to turn into one other space of focus for regulators and legislators who more and more don’t look kindly on ways that might be seen as proscribing competitors. In-game purchases now make up virtually 85% of video games content material spend, so it might be an enormous boon for publishers if they may freely circumvent distribution charges for in-game content material.

And one other main business pattern can also be unhealthy information for distributors: the rise of in-game promoting. In-game promoting already accounts for over a 3rd of cell video games income, and is maybe set to turn into extra widespread on PC and console as nicely. Primarily based on present developments, Omdia forecasts that promoting may account for over 40% complete video games income by 2027. As a result of this income comes from advertisers fairly than shoppers, it largely bypasses distributors. Certainly, this is without doubt one of the main appeals of in-game promoting from the angle of publishers. With promoting quickly rising a share of video games income, distributors may be tempted to attempt to discover methods of capturing a share of the advert income earned on their platforms. However once more, any such try would run an enormous threat of being stymied within the present regulatory local weather, leaving distributors with little alternative however to observe this market phase develop exterior their management.

Distributors should diversify

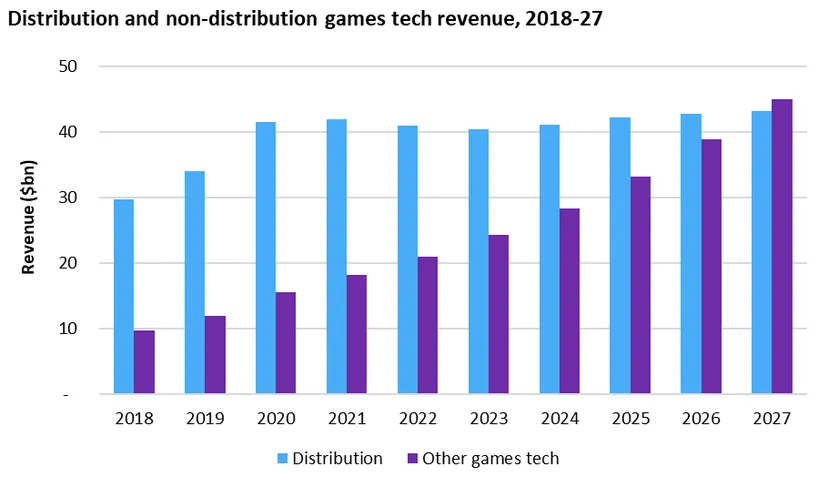

The confluence of all these components—elevated competitors, the expansion of cross-platform gaming, and the rise of in-game promoting—mixed with a a lot much less favorable regulatory surroundings is already hitting distributors’ backside strains. Their share of complete video games income slipped from 20% to lower than 18% between 2018 and 2022, and is ready to fall additional to 12.5% by 2027, by Omdia’s estimation. It is a large change within the division of income within the video games market, with probably far-reaching penalties.

Publishers can count on to pay much less of their income to distributors than previously, although this is not going to translate routinely into increased income. A number of the modifications decreasing distribution prices carry with them prices of their very own. That is significantly true of the rise of in-game promoting, the place adtech distributors can and do declare a big share of income. Elevated adtech spending alone will absorb a substantial proportion of publishers’ financial savings on distribution charges, whereas different price components like charges for cloud providers are additionally rising quickly.

Distributors themselves may also should adapt. Many are beefing up the vary of providers they provide in an effort to justify their price to publishers. Some, reminiscent of Microsoft and Google, have the benefit of already having a variety of tech providers at their disposal so as to add to their choices. Others are creating or buying capabilities throughout capabilities like analytics, cloud providers, and LiveOps instruments. This is sensible: whereas distribution income is stagnating, spending on different video games tech is booming, and can quickly overtake distribution income in Omdia’s reckoning.

Diversification is not going to be straightforward, nevertheless. Whereas video games tech spending is booming, these new markets are much more aggressive than distribution has traditionally been. Sony, Nintendo, and Valve have all seen this in previous as they struggled to commercialize sport engine and middleware know-how. Offering a extra numerous vary of providers to associate with their distribution platforms will imply working into sturdy competitors from the likes of Amazon and Unity, to not point out lots of of doubtless disruptive startups, which means that distributors should work quite a bit tougher for his or her income in future.